Fueled by inflation readings that have remained stubbornly elevated, the stock market, measured as the S&P 500 Index, entered bear market territory at market close on June 13, 2022. A bear market represents a decline in equity values by more than 20%.

And while crossing this arbitrary threshold of 20% has garnered a lot of media attention, the double-click into understanding the context of equity volatility can help to increase investors’ confidence to remain committed to their investment plan.

The most important thing to remember is that the phrase “it’s different this time” is one of the most dangerous phrases in investing. Downturns and bear markets are caused by different things and called different names, but the single-most durable investment truth is the long-term resiliency of capital markets and economic growth.

Sparking the current downdraft in stocks was the May reading of the Consumer Price Index (CPI) data – the most widely followed proxy for consumer inflation – coming in higher than expected. The CPI rebound undercut an expected trend towards the moderating of inflation. The headline inflation rate of 8.6% was the highest since 1981, driven predominately by accelerating food and energy costs. Food and energy prices have been adversely impacted by Russia’s invasion of Ukraine, two countries that play a vital role in the commodity supply chain.

Despite the headline result, there was some positive news sitting inside the inflation report. Namely, Core CPI, which excludes the volatile food and energy components, increased a more tolerable 6.0% over the last year and the annual rate actually declined from the previous month.

The post-pandemic reopening of the world is one of the major reasons that inflation is surging. The combination of businesses trying to get back up-to-speed after being shuttered through the pandemic (picture a car that hasn’t started in a year trying to get going again), mixed with the pent-up demand of Americans ready to upgrade the homes we’ve been confined to, go on a vacation, or get a proper haircut is creating an imbalance of supply and demand that is putting pressure on prices of everything from eggs to airfare to housing. The result? The highest inflation rates in four decades, sparking concern that’s driven markets into bear market territory.

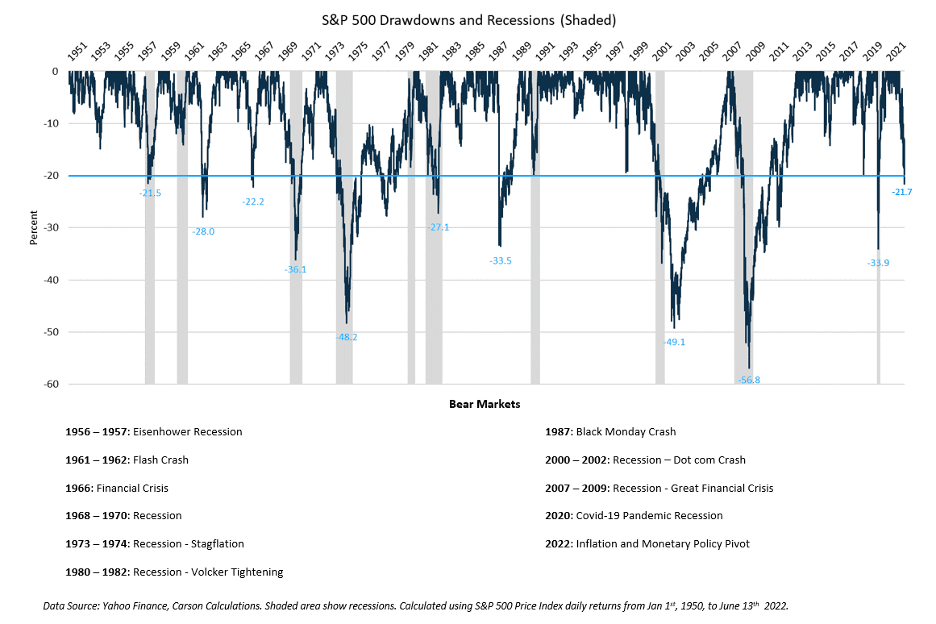

And while crossing into bear market territory is a headline-grabbing event, it’s important to note that it’s just an arbitrary line in the sand and we’ve been here before.

Moreso, history shows that bear markets – particularly those not associated with a recession – mark a potentially close proximity to near-term market bottoms. There’s a lot we can garner from prior bear-market periods that helps to place volatile periods like this into context and provide some cautious optimism to what the future might bring.

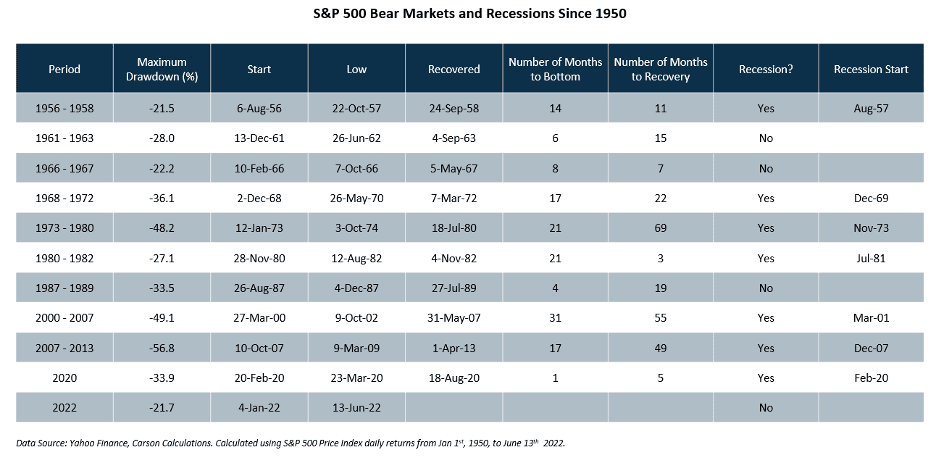

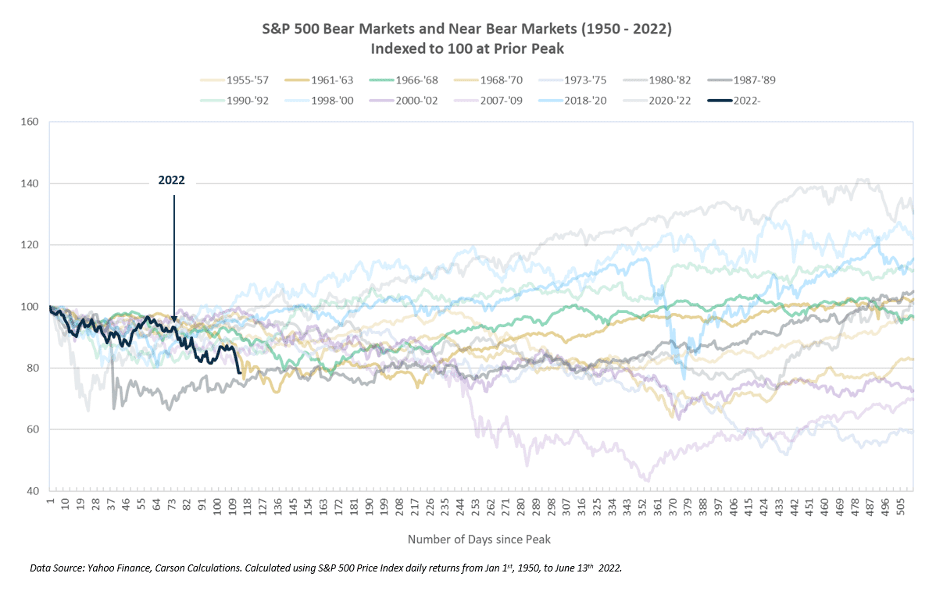

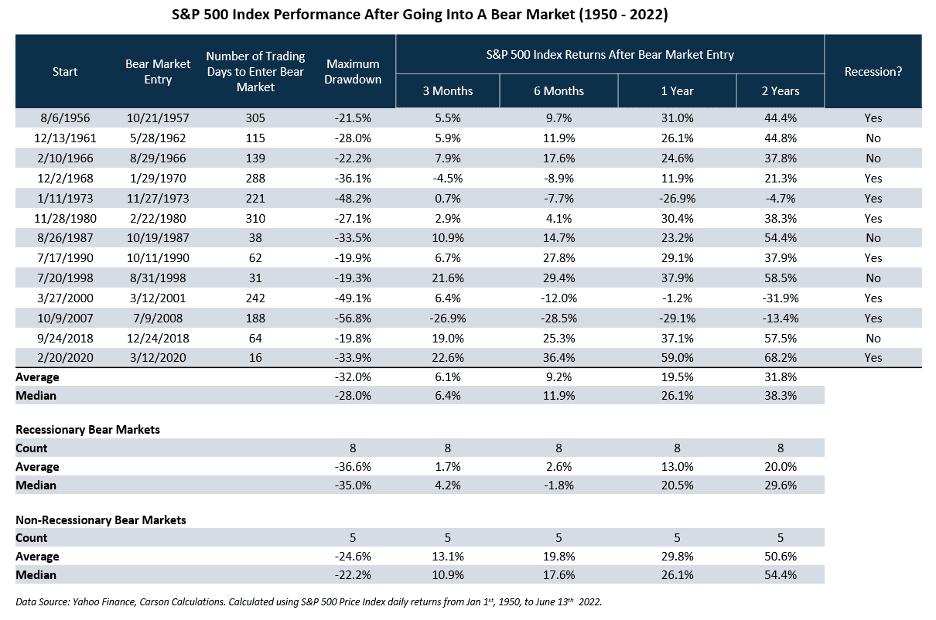

While this current market volatility is the eleventh bear market since 1950, it’s only the fourth to occur outside of a recession. This non-recessionary characteristic is a vital factor, as these versions of bear-market periods are usually shallower and lead to a swifter recovery than the majority of declines that occur during recessionary times.

For example, bear markets that occur outside of recessions average a 28% decline versus the 39% average decline during recessions. With this current stock market volatility already pricing in the majority of the typical non-recessionary bear decline, cautious optimism remains that the market is approaching a likely bottoming level – especially given the continued strength of most elements of the U.S. economy, including strong consumer spending and the best labor market in decades. Additionally, the full attention of the Fed to aggressively use monetary policy to turn the tide of inflation is in effect.

Another encouraging sign is once a bear market begins, recoveries are often closer than we anticipate. In only three of the last thirteen bear markets since 1950 (including three near bear markets), stocks moved further lower a year later. And each of these were associated with a major recession – something that is not where we are today. The other ten times, markets recovered significant following the bear market crossover.

Importantly, amongst five previous non-recessionary bear markets, similar to the economic conditions we are currently experiencing, all posted one-year gains over 23% and averaged 30% advances in aggregate.

While there are many things still to unfold for the market and the economy, we do not anticipate a recession on the near-term horizon, and thus view these historic trends to be the most likely paths for market conditions to follow.

Declining markets are always troubling to go through. But combining a longer-term perspective, mixed with past market behavior, can help provide important rational and fact-based context – as opposed to the emotional responses that get too many investors turned around.

What’s important to note is that despite all these market drawdowns, headline-grabbing bear market periods, and recessionary periods that occur on average every six years or so, markets have always weathered these challenges over the longer-term. Evidence is that all-time highs for stocks were just over six months ago, and stocks have historically climbed every single wall-of-worry presented before. And with a long-term perspective, it is likely that stocks will be there again.

The reality is that markets, like most things in life, are more fragile and susceptible to short-term fears than we ever imagined – but more resilient than we often give them credit for.

The reason, as the wise investment parable states, is that progress happens too slowly to notice, but setbacks happen too quickly to ignore. As an example, during the Great Recession of 2008 the market quickly lost 56%. It was an enormous deal. Books were written about it, and Congressional hearings were held. But the recovery over the next few years was powerful; the market tripled in value and barely anyone ever noticed.

Emotion is ignited by pain, fear, and suddenness, which makes market volatility hard to navigate. It’s easy to identify the challenges that sit right before us, but the case for how things will improve is often harder and more nuanced. History has proven that challenges faced by the market are managed, mitigated, or innovated away with a longer-term vantage. Today’s challenges are no different.

The reality is that markets are built to recover, which is why remaining steadfast to a long-term mindset and following a thoughtful investment plan is the key to a solid financial future.

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

Burt White is not affiliated or registered with Cetera Advisor Networks LLC. Any information provided by Burt is in no way related to Cetera Advisor Networks LLC or its registered representatives.